Red Flag Metrics That Indicate Revenue Cycle Management Inefficiency

Editor’s Note: In our previous blog post, “When Should You Outsource Revenue Cycle Management?,” we provided some guidelines for behavioral health providers considering whether to outsource revenue cycle management (RCM) for their billing. One of those guidelines was the review of key performance indicators, or KPIs. In this follow-up article, Infinity provides a deeper dive into the key metrics that can help providers assess the efficiency of their current billing and collections practices. Included are best practices and suggestions for process improvements to increase efficiency.

Key performance metrics are industry standard measures that allow healthcare providers to analyze and evaluate their practice in comparison to others to determine whether improvement may be needed.

The Healthcare Financial Management Association (HFMA) worked with industry leaders to develop a set of KPIs that set the industry standard for the performance of the revenue cycle within all types of healthcare organizations. Following are some “red flag” metrics that can be used to help assess the efficiency of existing billing and collections practices.

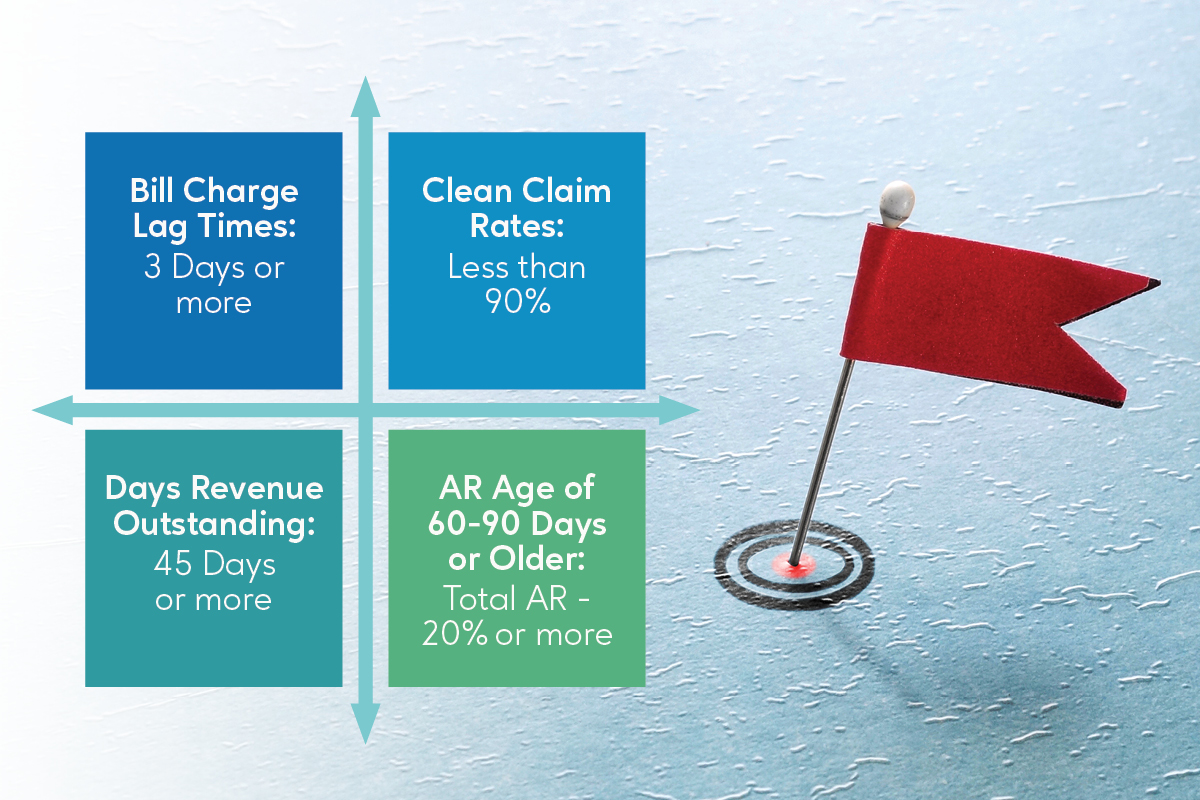

“Red Flags” Indicating It’s Time to Outsource Your Revenue Cycle Management

- Bill Charge Lag Times: 3 Days or more

- Clean Claim Rates: Less than 90%

- Days Revenue Outstanding (DRO): 45 Days or more

- AR Aged 60 to 90 Days or Older: 20% or more of Total AR

Bill Charge Lag Time

What it is: This is the measure of time between the date of service and the date charges for the service are coded and entered into the billing system. This should occur promptly. Charges that are not billed for days or weeks create cash flow issues.

Why it matters: The longer charge lag time is, the less predictable revenue cycle management cash flow becomes.

Best Practice: Document the patient encounter in the EHR, code and close same day.

Process Improvements: Make certain coding delays aren’t adding extra days to this process. Providers should respond promptly to MD queries. If providers typically provide documentation at close of workday, consider adjusting backend staff hours to begin and end later in the workday.

Clean Claim Rates

What it is: A clean claim is one that has no errors or omissions causing processing delays. The clean claim rate is a measure quantifying the rate at which insurance claims are successfully processed and reimbursed the first time they were submitted. Clean claims do not require the time-consuming manual input of additional information or extra verification efforts. They process smoothly, efficiently, and quickly.

Why it matters: A high percentage of clean claims means faster payment for the provider. It also means it is taking less time and money to process the claim.

Best Practice: The industry standard for clean claim rates is less than 95%. Many providers struggle to achieve better than 90% without using a reliable revenue cycle outsourcing provider to provide the speed, efficiency and expertise required.

Process Improvements: Track and review errors to identify which team members need training to prevent frequent errors. Where is the billing process bogging down due to missing or invalid information? Focus efforts on explaining to all team members the impact on reimbursement. In many practices, clinicians do not fully understand how timeliness in providing documentation affects payment.

Days Revenue Outstanding (DRO)

What it is: Days Revenue Outstanding (DRO) is often referred to as Days Sales Outstanding (DSO). Either term refers to the average number of days it takes the provider to receive payment for service. The DRO is a good measure of the efficiency of a collections department

Why it matters: Cash should be flowing into a business in a timely and predictable fashion. When a clinic or practice is receiving payments quickly, it is healthier overall from a business standpoint.

Best Practice: A DRO under 45 days is desirable.

Process Improvements: Determine what is causing payment delays and rectify with training or new information collection procedures. Is there a process in place for following up to gather supporting documentation so that claims can be efficiently processed?

Accounts Receivables – Aging (A/R)

What it is: Aging Accounts Receivable refers to the length of time an invoice has been outstanding, or a claim has been on hold.

Why it matters: Claims on hold for longer than 90 days are at increased risk of never being paid. Many insurance companies impose time limits for allowable billing. If the claim is not processed in a timely fashion, it may have to be written off.

Best Practice: No more than 15 percent of your total Accounts Receivable should be 60 days or older, and no more than 15 percent should be 90 days or older.

Process Improvements: AR tracking is an important billing function. Assign a tracker to review aging claims to determine what is responsible. Is there an EHR issue automatically placing claims on hold? Is there a trend in incomplete documentation that could be remedied with training? For many providers struggling with aging AR, the solution is to work with an outsourcing provider with the expertise to quickly identify trends, and address issues that leave claims unbilled or uncollected.

Revenue Cycle Management Outsourcing can make noticeable improvements to clean claim rates, Days Revenue Outstanding (DRO) and aging Accounts Receivable (AR). And, when a provider also works to improve Charge Lag Times, the overall improvement can be dramatic.

Infinity can help

If your practice has a backlog of unpaid bills or if your claims are being denied, Infinity’s knowledgeable team can provide revenue cycle management outsourcing services for timely and optimal reimbursement. Driving your cash flow and optimizing profitability, we work hand in hand with the industry’s leading network of healthcare compliance experts.

Use the form below to begin the conversation about how to get paid faster, more reliably and boost your margins.